Providing valuable information

Providing valuable informationon price uncertainties

For many years SYSPOWER has provided hourly spot price forecasts for both system price and all Nord Pool price areas. In addition the Scenario module can now provide uncertainties to these forecasts which can be of great value to both production planners, traders and other market participants.

Our short-term price forecasting model is based on the same principles as the Nord Pool spot price calculation, i.e. maximization of the social surplus. In reality this is achieved by minimizing the area price differences by flowing power from low price areas to high price areas.

In the SKM model the demand curves come from a separate neural network model that estimates hourly demand for all Nord Pool areas. This demand is assumed to be price insensitive and the corresponding supply curves are then estimated by the analyst in charge based on recent historical observations. The model also takes all UMMs on transmission capacities and production outages into account.

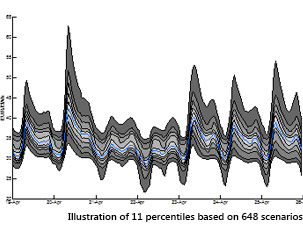

On top of this standard SYSPOWER approach we now offer two types of scenario runs:- Automatically generated percentiles based on several hundred scenario runs. These are run in the morning and results are published no later than 8:30 AM.

- Custom-made company specific scenarios that are based on your specific needs. Our setup allows for scenarios on demand, wind power production, nuclear and interconnector outages, continental prices, and supply curve uncertainty.

-

- A percentile based price span that can be easily implemented in production planning software, e.g. SHOP

- Overview of price uncertainties

- Custom-made scenario runs

- Six different interconnectors

- NO2/NL

- DK1/DE

- DK2/DE

- SE4/DE

- SE4/PL

- FI/EE

- FI/RU

The automatically generated short-term price scenarios will be launched and priced as an add-on module to SYSPOWER.